Project Freeman Phase 3: Implementation

The 3 Tests of Lawful Rebellion

B2. Stop Paying Tax

1. Notice to H.M.R.C

inc. Registration of Birth & 'Tax Fraud'

This Notice process was started in January 2010, although 'A Freeman' had already given notice in May 2009 under the 'Freedom of Information Act that he would not be filing any more tax returns until his tax records were sent to him (see the 'Freeman of Information' page)

Background

Why do we think we have to pay 'Income Tax'? Most of us have never read the legislation applicable to this.

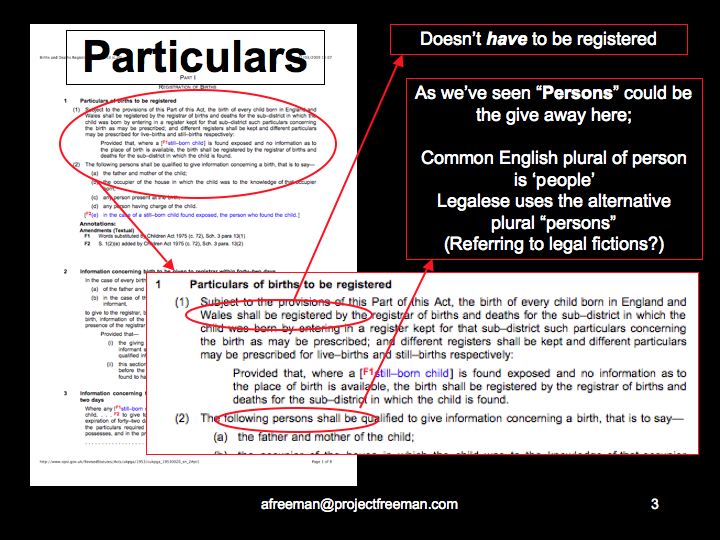

All 'Statutes' state that the 'Person' is liable, in this case for the 'Income Tax', but never define which type of 'Person' they mean

As we have seen, there are many types of 'Person' in Legalese. Our 'Legal Fiction' person is created via the registration of our birth, but are we obliged under law, or even under the civil 'Legal System' of Acts and Statutes to do this?

To answer this question 'A Freeman' researched the registration of birth process under the "Births and Deaths Registration Act (1953)"

This is what the Act says with regard to the "Particulars of births to be registered"

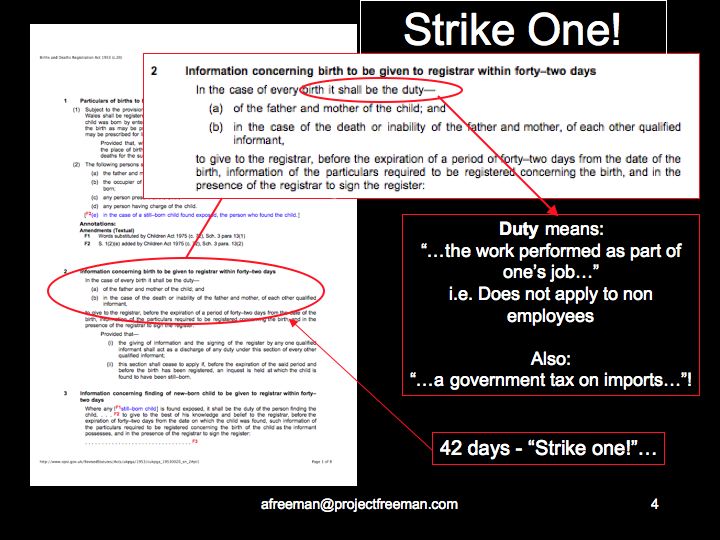

and, with regard to the information they want, this only talks about "duty"

In English one definition of 'duty' is "...the work done as part of one's job..." and it can also of course be a government tax on imports (so perhaps if a free man's baby is "imported" into the system the government can charge a tax on it??)

In Legalese there are 2 full pages of definitions of 'duty', the first of which is "... A legal obligation that is owed or due to another and that needs to be satisfied; an obligation for which somebody else has a corresponding right...". So, it's a legal obligation (under this civil legal system) rather than a lawful obligation under common or moral law

Registered Person's are "given" rights but then expected to fulfill "duties" within 'Society', but it appears that this does not apply to un-registered "people". Is it not a free man's right to decide whether they wish to take the benefit of the rights in return for the obligation of the duties (See Inalienable Human Rights)

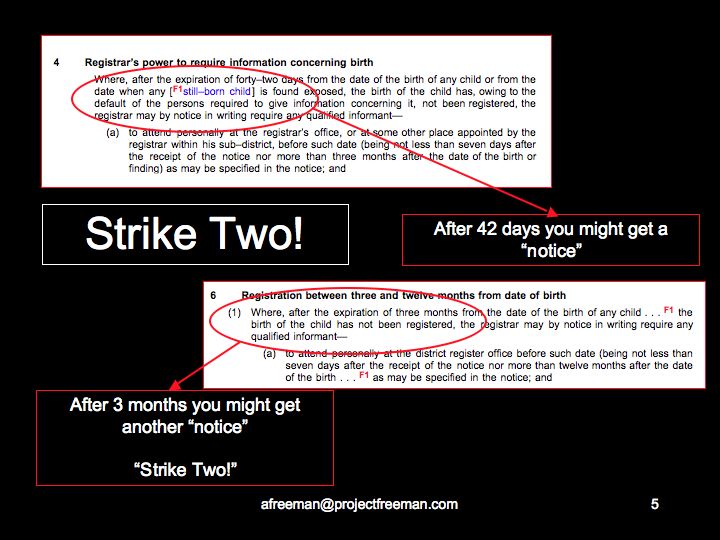

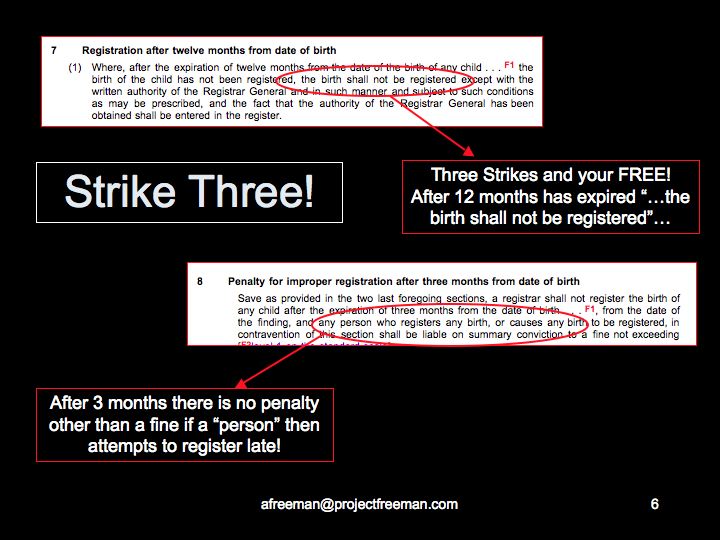

In any case, the first requirement ('Strike 1') of this Act is to give the information within 42 days of the birth

If the information is not given within the 42 days a Notice might be sent by the registrar

The second period ('Strike 2') is between 3 months and 1 year

If the information is not given after 3 months another Notice might be sent

then...

if a year goes by "...the birth shall not be registered. Three Strikes and you're out... of the system!

It seems that the only penalty then is a fine in the event that the birth is attempted to be registered late. If a free man does nothing it seems there is NO PENALTY

It appears that if there is no registered person, there is no tax liability

But what happens if a free man was registered by their parents (like the overwhelming majority have been) without realising what it meant, because they were not given 'Full Disclosure' as to the consequences. If we are already registered do we have to pay?

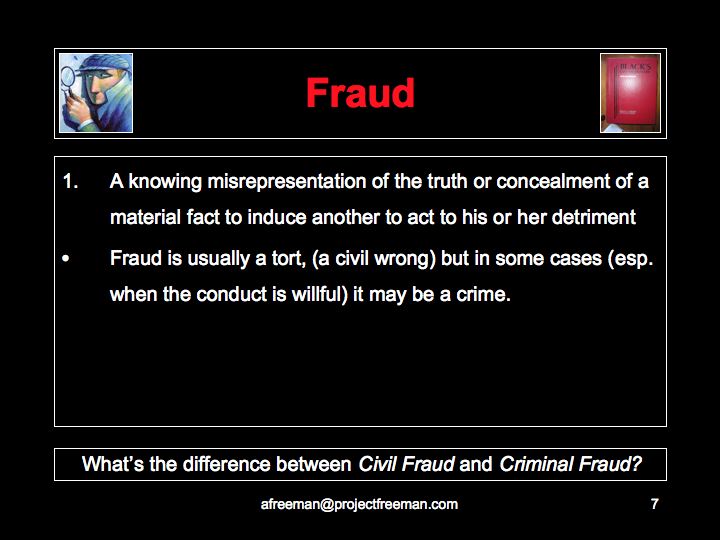

What about 'Fraud'

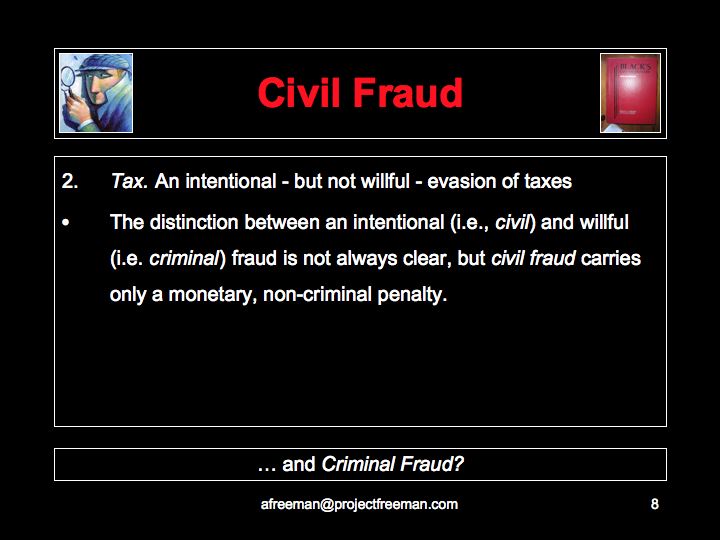

Civil Fraud is actually defined in Legalese as evasion of taxes but not "wilfully". It actually states that this only carries a monetary penalty

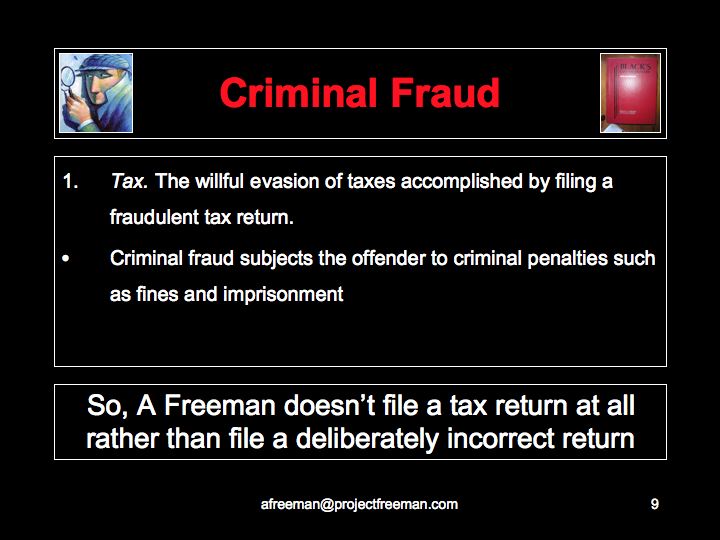

whereas Criminal Fraud occurs when a 'person' attempts to "fiddle" their tax return to avoid tax.

This is consistent with Common Law where fraud is apparently one of only two ways a person can be guilty of a criminal offence (the other apparently being 'encroachment' upon a fellow man by causing them injury or harm or loss or damage to their property)

So, if a free man withholds tax for moral or lawful reasons (as 'A Freeman' is doing) this is merely a 'Civil' issue punishable only by fines, whereas if they attempted to file a dishonest tax return it appears that would be a 'Criminal' offence and they could be imprisoned if found guilty, and quite rightly so.

Action

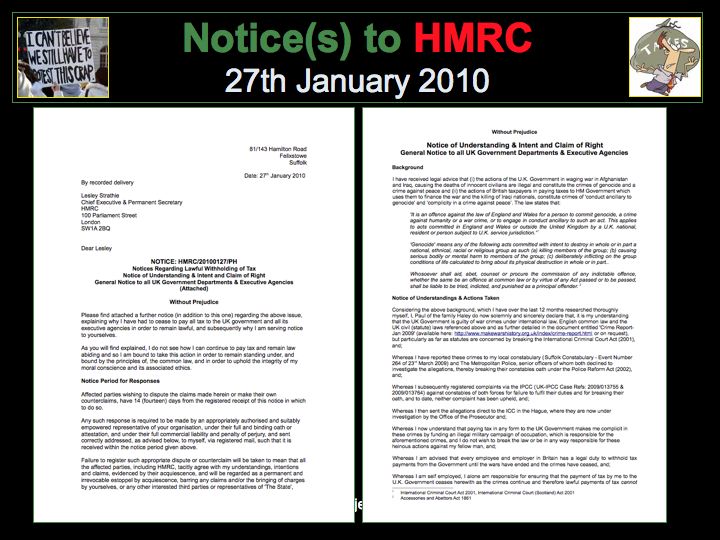

Step 1. A NUICOR (Notice of Understanding & Claim Of Right) was sent on 27th January 2010

It was addressed to The Chief Executive. This is important, it ensures some action will be taken.

Enclosures:

1. Covering Letter - explains what’s in the attached notice and includes the details for addressing replies correctly to 'A Freeman"

2. General Notice to all UK Government Departments & Executive Agencies - explains war crimes issue and legal dilemma of the ICC Act contradicting other Tax related statutesNotice Period:

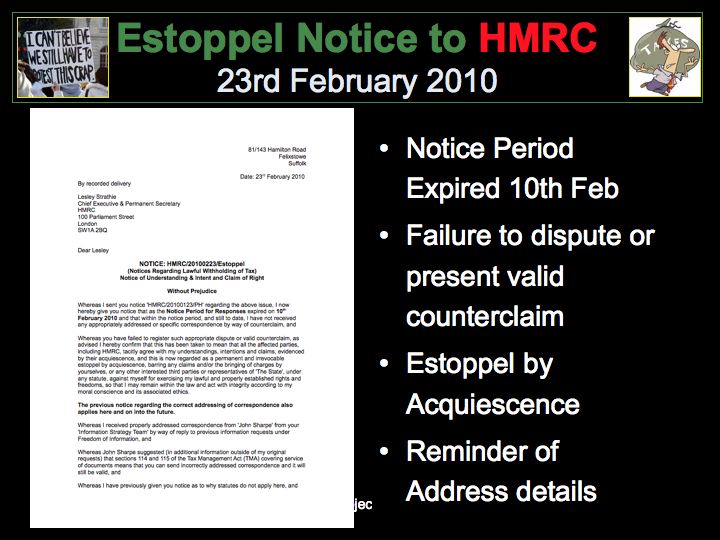

14 Days (Reasonable) Expired 10th February 2010. Nothing was heard back from HMRC before this expired.

Step 2. Estoppel Notice Sent 23rd February 2010

To see the Estoppel Notice click here. This Notice mentions other correspondence received from HMRC under a Freedom of Information request. You can see that on the 'Freeman of Information page here

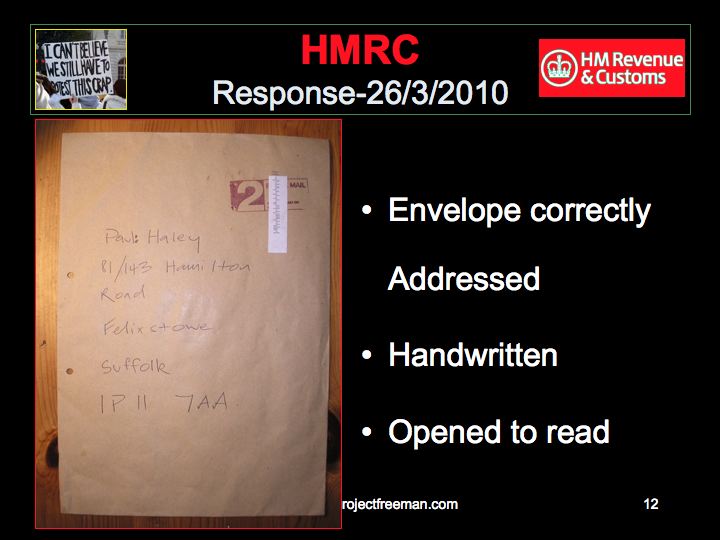

Step 3. Response Received Late (26th March 2010)

This was interesting as HMRC sent a brown hand written envelope correctly addressed as originally instructed so of course 'A Freeman' opened it...

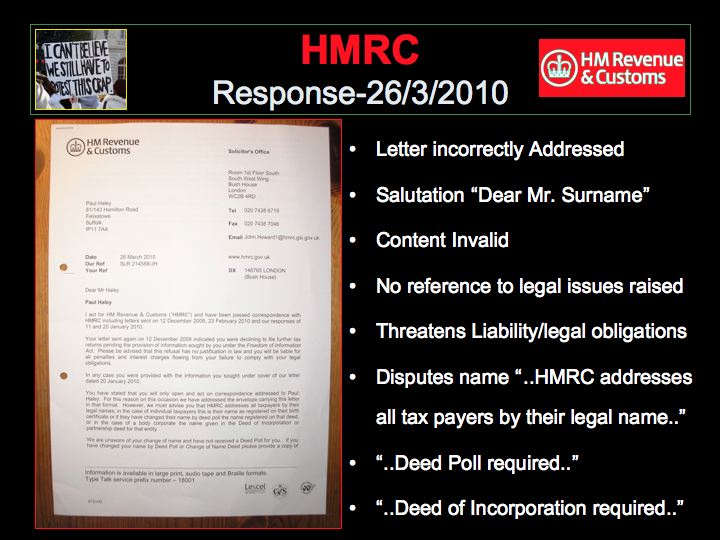

Summary of response:

... but unfortunately the letter inside the envelope was incorrectly saluted to the 'Legal Fiction', so of course the content was invalid under the terms of 'A Freeman's' Notice. They were trying to "pull a fast one" by correctly addressing the envelope to get 'A Freeman' to open it! And, as 'Estoppel' had already been claimed and this response did nothing to counter claim against it, this letter was ignored by 'A Freeman'

The full letter is here: Page 1 / Page 2

Outcome

No further tax returns have been submitted by 'A Freeman' & No Tax Paid

A computer generated statement addressed to the 'Legal Fiction' is sent periodically from HMRC with a £100 fine plus interest for each 6 months without a tax return being sent. This seems to be good practical evidence that this is only seen as a 'Civil' issue and NOT a 'Criminal' one.

These statements are all ignored by 'A Freeman' as they are incorrectly addressed and make no reference to 'A Freeman's' previous lawful Notices

'A Freeman' pays "No Tax For War" and hasn't filed a tax return since 2008

(this page last updated - 16th May 2011)